Private Equity & Venture Capital

Private Equity, Venture Capital & Family Offices

After the financial crisis there is an increasing focus on robust valuations, driven in part by increased regulation and oversight but largely from investors who are looking for independent opinions and greater transparency as well as consistency in portfolio company valuations.

The problem is that most external valuation providers are not prepared to provide advanced valuations for decision making. In fact, , the established valuation industry does not go beyond the limits of the regulatory accounting guidelines. As such, it still conducts basic analytic approaches without reflecting the complexity of today’s markets and business drivers.

Our advanced valuations can offer independence and at the same time a much deeper perspective: Since Private Equities cannot diversify risk completely given the few number of investments they hold, the Capital Asset Pricing Model (CAPM) cannot be well applied and risk might be underestimated. For this reason, we determine the risk profile of each investment in terms of Standard Deviation, Kurtosis, and Skewness allowing GPs a better tool for portfolio optimization. Our services include:

- Evaluation of individual investment opportunities or projects includes:

- Macroeconomic analysis of the region

- Market analysis of the sector,

- Strategic positioning,

- Identification and measurement of all internal and external risk-value drivers involved in the target,

- Advanced risk analysis using Monte Carlo simulation,

- Stochastic Forecast based on event probabilities and variables volatilities previously identified.

Portfolio Risk Assessment:

- Value at Risk

- Stress Testing

- Standard Deviation, Kurtosis, and Skewness

- Tornado Analysis,

- Portfolio Risk Optimization: Since Private Equities cannot diversify risk completely given the few number of investments they hold, the Capital Asset Pricing Model (CAPM) cannot be well applied and risk might be underestimated. For this reason, we determine the risk profile of each investment in terms of Standard Deviation, Kurtosis, and Skewness.

- Evaluation of individual investment opportunities or projects includes:

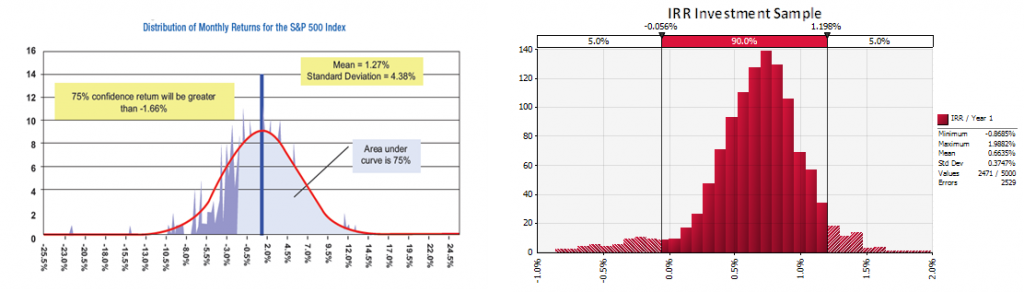

By analysing and understanding the return or value distribution of an investment which is affected by internal (company variables) or external (market variables) drivers, we can show how to mitigate the risk and how optimize the risk-return trade-off through portfolio management and other alternative investments. In the figure below, we compare the return distribution of the S&P 500 with the IRR of an hypothetical investment.

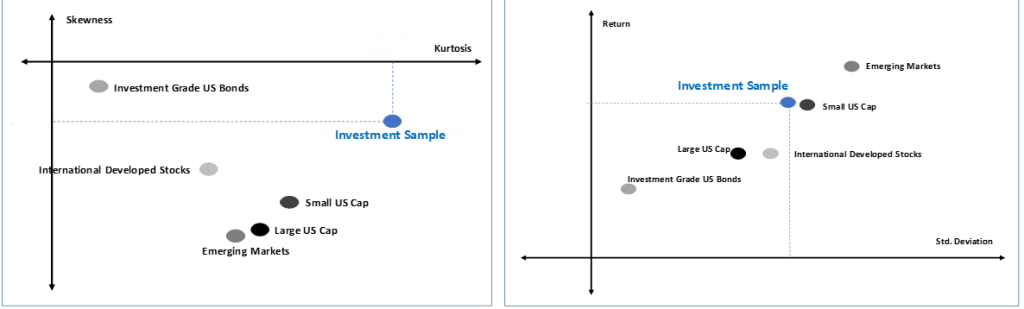

We use metrics like standard deviation, kurtosis and skewness to analyse the risk profile of a given investment. In the charts below, we show a sample in which we position the return of an Investment in terms of Standard deviation, Kurtosis, and skewness and compare them with other known market investments.

- By using advanced probabilistic analysis we are able to measure each single risk driver overcoming the limitations of the capital asset pricing model for illiquid asset investments in partially diversified portfolios.

- Transaction support, including valuation of assets and strategic economic valuation (based on value-drivers, strategic scenarios, uncertainties/risks).

- Portfolio Valuation: Sum-of-the-parts, “reduce form” or risk-factor models

- Predictive portfolio analytics.

- Stakeholder communications planning.

- Integrated Reporting

- Model advisory, testing and training.

Sectors

Looking for a first-class business plan consultant?

London

78 York Street

London, UK, W1H 1DP

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta