Our Products

Cryptocurrencies and ICO Valuation & Risk Modelling

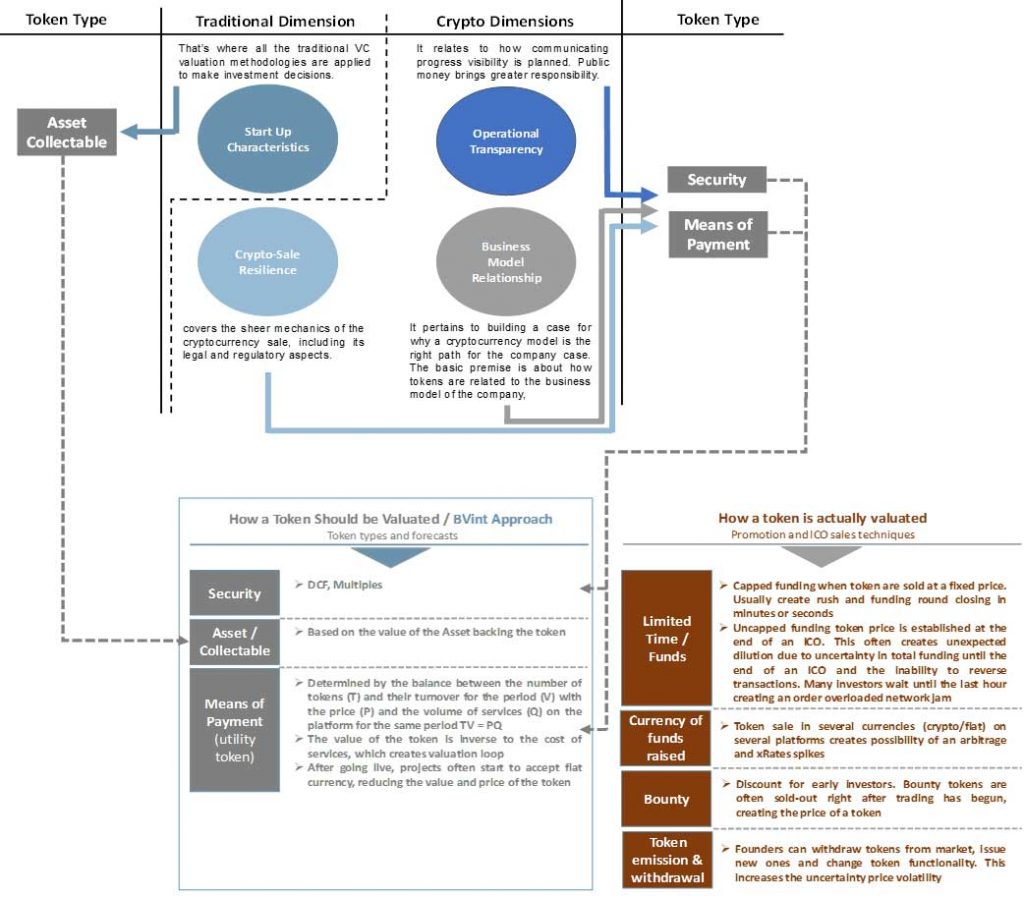

Our valuation is aimed at measuring the value for shareholders, Investors, stakeholders and society. The cryptocurrency space is filled with parallels to traditional capital raising and in many cases in compared to IPOs. So much of the vocabulary is directly borrowed from the traditional capital raising and IPOs. However, upon detailed examination, many of these parallels might lead to valuation practices base on “fear of missing out” (FOMO) while it should be based on project development forecasts and the nature of the token. To avoid this problem BVint approach classifies tokens in six dimensions instead of the traditional two (Security and Utility) which is a gross oversimplification of reality. In a start-up ICO, we distinguish three types of tokens:

- Security: it refers to the value of the investment in an ICO project which includes capital gain expectations at risk.

- Asset Collectable: it refers to the part linked to a particular business project or start-up looking for fundraising.

- Means of Payment: it refers to the value of the currency.

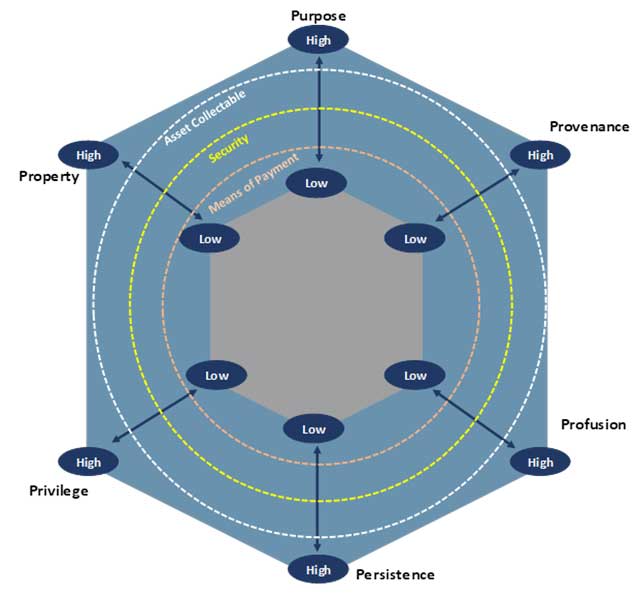

The figure below classifies the three types of tokens according to the six dimensions. This positioning as high or low will define the methodology of valuation approach to be used to avoid FOMO.

The six dimension of the previous figure depend on the following drivers:

I.Purpose: – The objective of the token is a primary dimension that describes the externality and existence of the purpose of the token. It may unlock some type of value or make a system work, or it may be the purpose when it is a currency.

II.Provenance: The provenance of the token concerns the centralization of the issuer. This is a very important factor. Will there be successive rounds of issuance from one central party or is the token issued in a decentralized manner.

III.Profusion: The profusion is tightly linked to provenance and concerns the issuance parameters. This ranges from one issuance for a fixed amount of tokens through a multi-round issuance up to a potentially continuous and unlimited issuance.

IV.Persistence: Some tokens may be “burned” in order to retrieve their value, for example a token that represents temporal access to a system or service. This dimension runs from tokens that are per (BTC) and may be transferred any number of times to tokens that are used only once.

V.Privilege: Privileges and rights granted to the holder of the token. A token can have no privilege other than ownership or it may grant privileges, such as a vote, an access, or a share in some future value.

VI.Property: This dimension represents the ownership aspect of the token. Does holding the token symbolize ownership of another good or asset? This dimension ranges from no property (Bitcoin), through simple claims (debt ownership), up to outright equity ownership (company shares).

Asset collectables that are linked to a project have a high level in terms of these six dimensions as shown in the previous figure. Securities which imply an investment with a potential value have a medium level and the means of payment have a low level. These levels define the valuation approach for each token as shown in the figure below.

The final scope of our valuation approach is Decision Making and Value Creation:

I.Long Term vs. Short Term Decisions: It will allow management to assess decisions, trade-offs and sacrifices into their business model.

II.Integrated Thinking for Integrated Decisions: It leads to multidimensional decision-making and actions. It is the product of the processes of connectivity and multidimensional thinking in the organization. It is therefore not just about the valuation report, but about the process of the organization’s unique approach to value creation.

III.Valuation Decisions: Uncertainty in valuation, which can overvalue or undervalue all the dimensions involved in an ICO, can be lowered by increasing the amount of information available to shareholders and investors. The ultimate goal is to enable investors to make more efficient and effective decisions.

BVInt Valuation Services:

1.ICO General and Qualitative Analysis and Evaluation

- Tokens Positioning and Multidimension Evaluation

- Networks and Issuer Value Positioning and Analysis

- Evaluation of the Management Team Composition, Background, and Experience

- Analysis of the Stage of the project and VC investments

- Analysis of the Supporting Community and Media

- Token Purpose Definition

- Token distribution analysis

- Quality of the code Analysis

2.Collectable Asset: Project and Start-up Advanced Strategic Valuation which Includes:

- Economy and Political overview: Risks Impacting the Projects in the long term.

- Market analysis

- Strategic Analysis

- Risk – Value drivers identification, analysis and assessment (using Monte Carlo simulation and Palisade Risk 7.0).

- Risk Flow and Risk Map as shown in appendix

- Complete business plan and Free Cash Flows

- Independent valuations using all methodologies required by the European Venture Capital Association (EVCA) and the European Directive (AIFM) which includes:

- DCF at Risk

- rNPV, VaR and VaR based on NAV volatility

- Real Option pricing analysis

- Market Comparables and benchmarking

3.Advanced Security Valuation:

- Crypto Asset Cost of Production Analysis

- Network, Blockchain, Market analysis

- Risk – Value drivers identification, analysis and assessment (using Monte Carlo simulation and Palisade Risk 7.0)

- Forecasts

- Independent valuations using all methodologies required by the European Venture Capital Association (EVCA) and the European Directive (AIFM) which includes:

- DCF at Risk

- rNPV, VaR and VaR based on NAV volatility

- Real Option pricing analysis

- Market Comparables and benchmarking

4.Advanced Currency Valuation:

- Determined by the balance between the number of tokens (T), their turnover for the period (V), and the volume of services (Q) on the platform for the same period TV = PQ.

- Analysis of the potential valuation loop created by the inverse relationship between the value of the token and the cost of the services

- Analysis of the value evolution expected considering in case the project accept fiat currency after the ICO, reducing the value and price of the token.

5.Final Reports Includes:

- Complete Consolidated Valuation Report

- White Paper

- Executive Summary and Teaser

Quick Links

Looking for a first-class business valuation consultant?

London

78 York Street

London, UK, W1H 1DP

Switzerland

Malta

6 Sir William Reid Street, Gzira, Malta